While reading quick summaries of different kinds of bonds, I paused on the description of title bonds. I think they illustrate well the basic idea behind bonds, and how they act as a mechanism of trust between two parties.

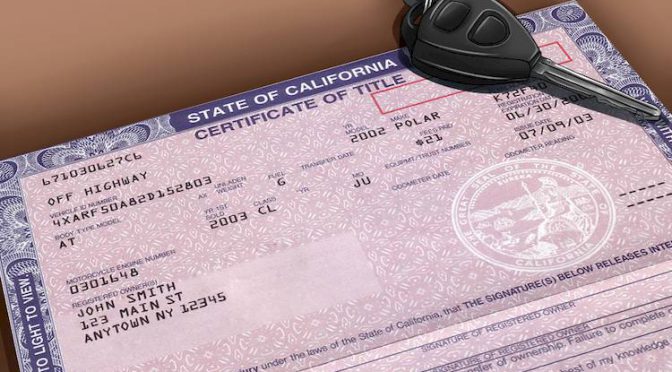

Title bonds are required usually by state governments before they will reissue titles for larger items like cars. They bond you to your claim that you have legitimate ownership of the item in question, so that people can’t just go around stealing things and filling out some paperwork to have it legally defined as theirs.

For instance, let’s say you lost your copy of the title to your truck that you bought from that shady little used car lot way out of town. Maybe you never got a proper title from the dealership; they didn’t have one at the time, they said, and a bill of sale would be just as good. After a few years, you decide to sell it, but the buyer says that a bill of sale is not enough, that you will need to get a title to transfer to him. You try to find the dealership to get a copy, but find out that they went out of business, got shut down for “correcting” their lot’s odometers, and that no trace of them remains.

Now, in order to get a title reissued by the state, you will need to buy a title bond from a bonding agency like Bernard Fleischer & Sons. The state will generally decide how much we will have to write the bond for. That bond will guarantee any damage done to the car while it is in your possession, in the event that a more legitimate title-holder materialized later on. Perhaps you discover that your dealership was “correcting” ownership on their cars as well as mileage. Now you just have to hope that the shady dealership way out of town had posted a Motor Vehicle Dealer Bond.